Inflation did not spike. It eased.

January’s CPI reading came in below expectations, signaling that price pressure continues to decelerate into early 2026. For markets positioned defensively after months of sticky data, that shift was not incremental. It was directional.

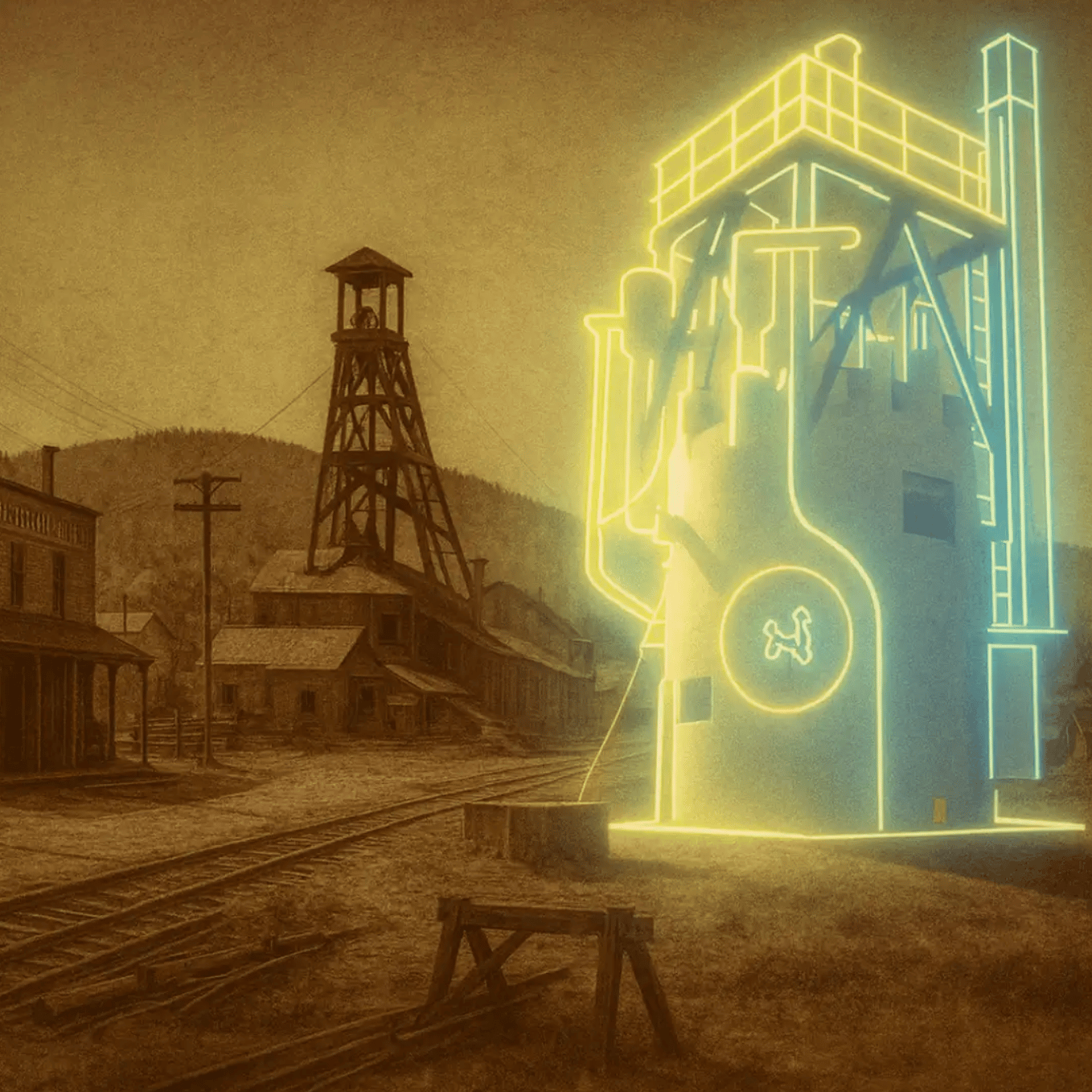

Forget what the media says about an AI bubble, and forget the market swings…

Jeff Brown says we’re on the edge of a $100 trillion boom, thanks to a breakthrough tech hidden in a dying coal town in Wyoming… it sounds crazy, until you see what he uncovered. But there may not be much time to get in on this tech before everyone catches on.

The Core Signal: Disinflation Is Regaining Credibility

The headline CPI print moved lower than consensus estimates, reinforcing the idea that policy tightening is still working its way through the system.

This matters because the last several inflation cycles trained investors to expect reacceleration. Instead, January delivered moderation.

Capital responds to trajectory, not just level. A confirmed cooling trend revives the probability of mid-year easing and stabilizes long duration assets that had been under pressure.

The signal is not victory. It is validation.

The Mechanics: Why This Print Moves Markets

Three forces amplified the reaction:

Shelter inflation showed incremental slowing

Goods prices continued to normalize as supply chains stabilized

Energy prices did not reintroduce volatility

Bond markets reacted first. Treasury yields pulled back as traders adjusted rate cut probabilities. Fed funds futures repriced the path of policy modestly toward easing.

Equities followed. Growth sectors, particularly long duration technology names, found support as discount rate expectations softened.

The dollar weakened slightly, reflecting a narrowing rate differential narrative.

None of this signals aggressive easing. It signals optionality.

Who Is Moving Money

Institutional allocators had been defensively tilted toward cash and short duration instruments.

A softer CPI print invites rotation.

Longer duration Treasuries regain appeal.

Quality growth equities find renewed sponsorship.

Rate sensitive sectors such as real estate and small caps receive incremental attention.

Meanwhile, defensive positioning in commodities tied strictly to inflation hedging becomes less urgent.

This is not a wholesale shift. It is a rebalancing of probability.

What It Means

The Federal Reserve does not cut because markets ask. It cuts because inflation allows it.

January’s data does not guarantee easing. It reopens the door.

For investors, the lesson is structural: inflation credibility anchors valuation stability. When CPI moderates sustainably, risk assets trade on earnings again instead of policy fear.

Momentum mapping now points toward stabilization, not escalation.

The question shifts from how high to how long.

Signature Insight

Inflation no longer looks like a resurgence story. It looks like a glide path.

And glide paths change capital flows before they change headlines.